Market Quarterly | June 30, 2024

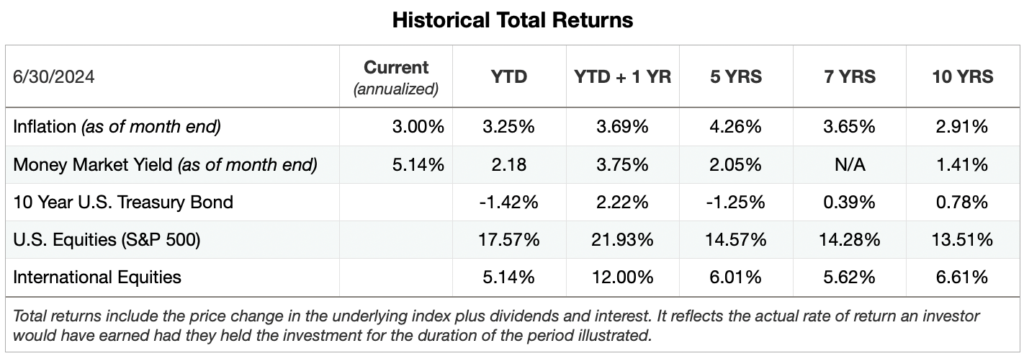

June set another record high for the U.S. stock market (S&P 500), boosting the year-to-date return to 17.57% compared to 5.14% for international stock markets.

Money market funds continue to be an ideal placeholder for ultra-short term investments; the current yield trounces that of other fixed income investments.

Fixed income investments, as measured by the 10 year U.S. treasury bond, has not fared so well. The year-to-date and trading 5 year total returns are underwater, due primarily to the risk of interest rates inching up slightly.

Inflation has begun to cool, dropping to an annualized rate of 3.0%. That’s the lowest reading since April 2021; good news for everyone, but it doesn’t mean prices are about to fall.

TOP ISSUE: Inflation

Inflation has been a significant headwind for everyone, but it is finally cooling down. That doesn’t mean prices are falling, and for good reason we may not want them to!

INFLATION BEGINS TO COOL! The pace of inflation cooled in June, declining to an annual rate of 3%. That’s the lowest level since it peaked 38 months ago. But that doesn’t mean prices are falling or are expected to fall any time soon. In fact, it may be best that they don’t.

Inflation vs Deflation

Inflation, aka the Consumer Price Index (CPI), is the rate at which the price of a basket of goods and services increase over time, typically 12 months. This doesn’t translate into lower prices for the entire basket of goods. So when will prices go down? Maybe never.

Sure, certain grocery items (milk, eggs, bread, etc.) and energy (gasoline, heating oil, diesel fuel) may decline for brief periods, but don’t expect the price of other items that we purchase and consume to decline.

Declining prices, aka Deflation, is when the price of goods and services continue to fall due to lack of demand. If consumers expect prices to fall they may delay a purchase to lock in the lowest price. While this seems like a great idea, if it is widespread then producers and manufactures will decrease production as a result of falling demand. That typically translates into layoffs, plant closures, and other measures companies take to minimize losses as they adjust to lower demand. Yes, prices decline but if work hours are reduced, jobs eliminated and factories closed, are we better off?

For these reasons the Federal Reserve, the government entity responsible for managing interest rates and influencing inflation, sets a long-term target inflation rate of 2%.

Interest Rates, 2% Inflation & a Soft Landing

As we have seen over the past three years, the Federal Reserve has raised interest rates several times to tap down inflation. The desired result is not always immediate, but compared to other economies (Japan, China, England, etc.) they are effective and continue to adjust rates until they hit their long-term target of 2%.

Unless there are systemic shocks in the near-term we expect inflation to continue its gradual descent, eventually reaching the Federal Reserve’s 2% target which should keep the U.S. economy on solid footing.

A DEEPER DIVE: Performance by Asset Class

Investment performance is primarily the result of how your funds are allocated across various asset classes. In this section we focus on the three dominate categories, Cash, Fixed Income, and Equities.

Cash & Money Market Funds

Cash has been the safe bet for ultra-short investments. On a current annualized basis its total return is 2.14% above inflation; quite a remarkable spread compared to historical norms where the spread is usually negative.

The outperformance to inflation is the result of lingering concerns that interest rates may inch back up, or at least not come down in the near-term, and an unexpected drop in inflation by the end of June.

Going forward we expect the yield on cash and money market funds to trend downward, especially if longer term interest rates begin to fall. In the meantime its an attractive investment for ultra-short investment needs (those less than 24 months).

Bonds & Fixed Income

The bond and fixed income market is very broad and encompasses numerous elements (coupon rate, current interest rates, default risk, reinvestment risk, duration) that lend to greater complexity. For these reasons our primary analysis for fixed income is the 10 year U.S. treasury bond. It serves as a barometer for the broader fixed income market and is considered to have zero default risk.

By the end of June the yield on the 10 year treasury had fallen to 4.48%, meaning that the market value of bonds went up, trimming prior losses but still leaving treasuries in negative territory with a year-to-date loss of 1.42%. However, on a positive note, for the trailing 18 months the total return is positive, returning 2.22%, but still negative for the past 5 years.

Most of the erosion of value in bonds and fixed income investments over the past few years is the result of historically low interest rates, hitting a low point in April 2020 when the yield on the 10 year treasury was 0.62%. (interest rates go up bond prices go down) From that low point the only direction for interest rates was up, reaching a high of 4.77% in October 2023.

For now it appears that interest rates (i.e. the yield on 10 year treasuries) have stabilized and may begin to come down when the Federal Reserve is expected to lower borrowing cost later this year. With this stability and rates returning to historical norms, bonds and fixed income investments are becoming attractive when properly matched to investment needs that are within the next 2 to 7 years.

Stocks / Equities: U.S. & International Markets

The S&P 500 serves as a proxy for the U.S. stock market and the MSCI EAFE for the international markets. Total returns include price changes and the reinvestment of dividends.

U.S. Stock Market

June was another record month for the U.S. stock market; primarily driven by large technology stocks (Apple, Microsoft, Nvidia, Tesla), bringing the year-to-date total return to 17.57%, well above the historical average of 12.21%.

The market seems to be driven by sustained corporate profits, even during an environment when interest rates were increasing. This has defied expectations, and may be sustainable in the near-term as the fear of future interest rate increases seem to subside.

The U.S. market has also been perpetuated by strong consumer demand from retirees.

With the stock market chugging along at a solid pace retirees have seen their 401(k) balances reach new highs, giving them the confidence to spend more. This has also created challenges for the Federal Reserve when they expected demand for goods and services to fall with rising interest rates. The end result was higher inflation for an extended period, but those trends appear to be falling in line with historical norms, which may bode well for the U.S. market.

International Stock Market

The international markets continue their decade long lag to U.S. markets, posting an anemic year-to-date return of 5.14%. That’s 70% lower than the total return for the U.S. market and almost 50% lower than the 10 year average.

Anemic returns have created significant headwinds for investors in target-date funds which have a substantial portion of the equity holdings invested in international and emerging markets.

However, the consensus among money managers is that the international markets will slightly outperform the U.S. market over the next 10 years. But that’s been the assumption over the past decade and those returns have not materialized.

Much of the outperformance of the U.S. market relative to international markets has been driven by sustained consumer demand in the U.S., and a relatively stable political environment and government institutions. Time will tell how this plays out in November and January.

SUMMING IT ALL UP

On the surface it appears that inflation and interest rates are headed back to their historical norms; a catalyst driving the stock market.

Geopolitical risks and systemic shocks are the greatest concerns for the next few years, especially as governments around the world become more isolationists. It reminds me of the history lesson of what happened to China with the erection of the Great Wall. Sure it protected them from external forces, but it shut them off economically and has taken them over 700 years to regain their footing.

Time is of the essence; pare short-term investments (cash, money market, short-term bonds, etc.) with short-term investment needs; pare long-term investments (stocks/equities) with long-term goals (those that are 7+ years out).

The Historical Returns table illustrates the importance of properly matching your investments to a specific goal. A mis-match may mean significantly lower investment returns over the long-run, or too much market risk in the near-term can result in substantial short-term losses where there is no time to recover.

Disclaimer: This article is intended to be educational only and not specific investment advice. All investors should consider their unique circumstances and risks while making investment decisions.